OPTIMIZE THE PRICE OF EVERY TRANSACTION

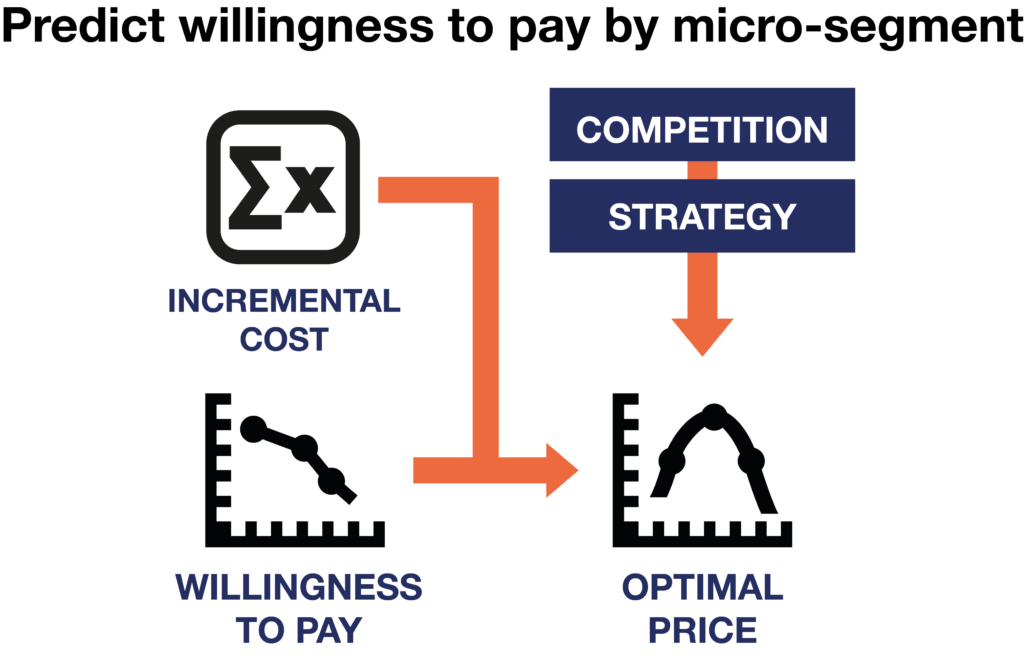

Fixed prices are based on average estimates of costs and customer willingness to pay. They are sub-optimal because they ignore the variation of these factors from transaction to transaction. Dynamic Pricing enables to calculate more precisely these factors at a transaction level thus increasing win rate and margin by transaction.

Predict willingness to pay by micro-segment

Do not leave value on the table and do not loose sales because you under-estimate or over-estimate willingness to pay (WTP). Use your data to estimate WTP by micro-segment and combine these insights with the results of market research and competitive intelligence.

Fill excess capacity and leverage peak-load pricing

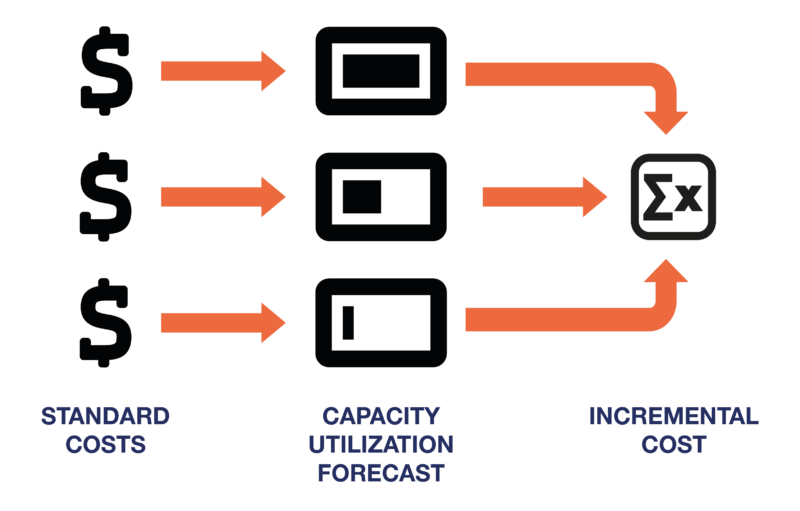

Identify when and where forecasted demand is below capacity and apply targeted incentives to generate additional sales – instead of overall price cut to avoid price dilution. Apply a premium to offset higher operational and opportunity costs when/where demand is greater than planned capacity

COMPONENTS

OP Dynamic Pricing includes a set of components that you can use separately or in combination. Each component requires to activate specific data sources.

Implementation and Integration

COMPONENTS

OP Dynamic Pricing includes a set of components that you can use separately or in combination. Each component requires to activate specific data sources.

Implementation and Integration

LEARN MORE